PayID is a cutting-edge payment solution introduced in 2018 by the New Payments Platform (NPP). The NPP is a reputable infrastructure owned by 14 Australian financial institutions, including the Reserve Bank of Australia. The NPP’s primary goal is to make payments in Australia easier, safer, and faster.

PayID is a payment service launched by Osko and supported by the NPP. As such, Australia’s most trusted banks implemented the payment solution, leaving no room for safety concerns. PayID facilitates near-instant financial transactions without compromising on safety.

Australians have to enter their BSB code (a six-digit code that consumers can find in their online bank accounts), account number, and cardholder name to transfer funds from their bank accounts to a merchant or another person. Remembering that information can be challenging, and if you enter one wrong digit, you can send money to the wrong recipient. Furthermore, most people are reluctant to disclose their banking details.

Instead of entering your banking credentials, you can use PayID to transfer money directly from your bank account. A PayID is a unique identifier linked to the bank account that allows you to receive payments through the NPP or Osko. There are four types of PayIDs, including an email address, a mobile phone number, an ABN (Australian business number), or a company’s name.

PayID is an innovative payment service that makes getting paid easier. If someone wants to send you money, you have to provide them with your PayID. A praiseworthy aspect of the payment service is that it can be also used to receive money.

Registering an Account with PayID

PayID is a service that over 100 accredited Australian financial institutions and banks support. Therefore, you do not need to open a separate PayID account. Instead, you have to check whether your bank supports PayID. A list of the participating financial institutions is available on PayID’s official website. You can also contact the customer support department to confirm whether you can link a PayID to your bank account.

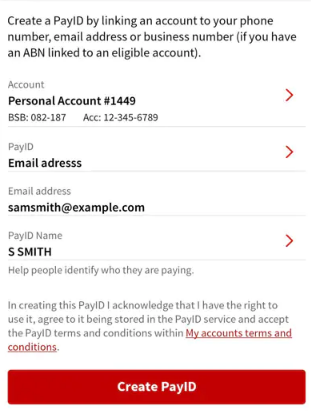

If you have an online bank account at a participating financial institution, you can log into it and create a PayID. Most financial institutions offer dedicated mobile apps, allowing their customers to manage their money even on the go. If you have such an app installed on your touchscreen device, you can log into it by entering your online banking credentials. PayID does not have a dedicated mobile app but is compatible with various touchscreen devices through your online banking.

The process of linking a PayID to your bank account is stress-free and takes no more than a few minutes. Note that if you use your ABN as your PayID, you might have to wait up to two business days because manual verification is required.

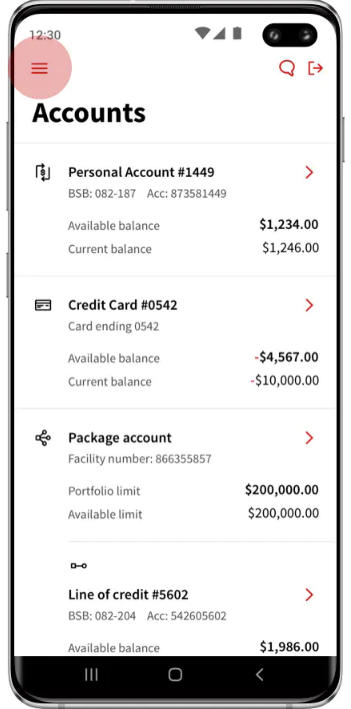

- Log into your online banking

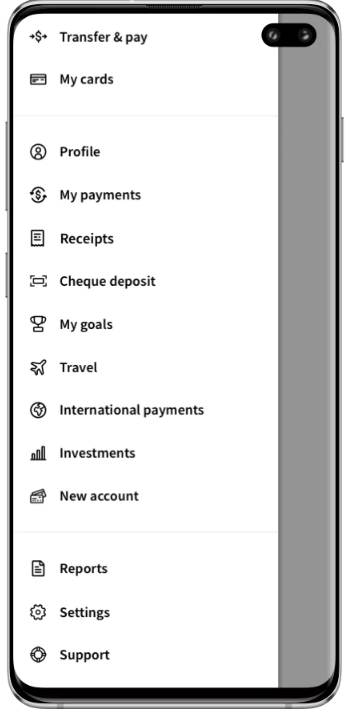

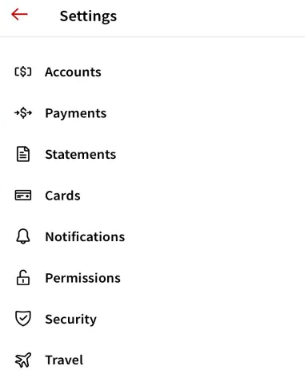

- Select “Menu” and tap on the Settings button

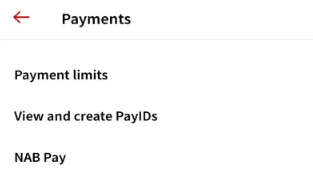

- Select Payments

- Tap on the View and Create PayIDs button

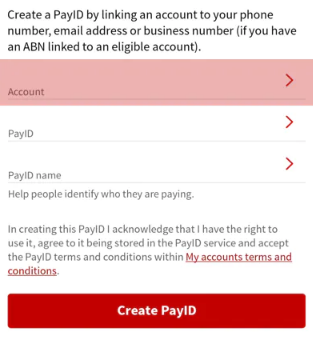

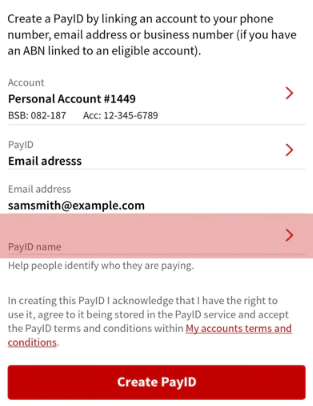

- Select the Create a PayID button and tap Account

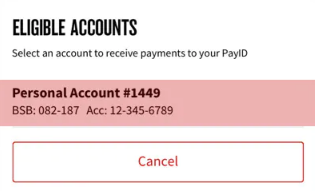

- Choose the account you wish to link to a PayID

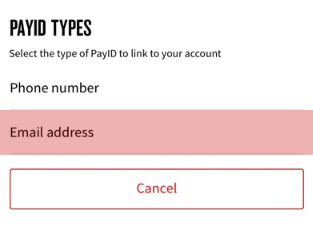

- Select a PayID type

- Enter a PayID name. Keep in mind that you cannot change the PayID name later

- Tap on the Create PayID button

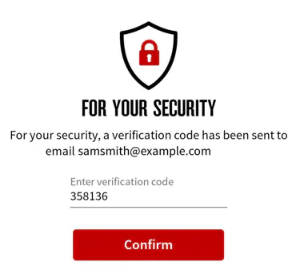

- An SMS with a security code will be sent to you

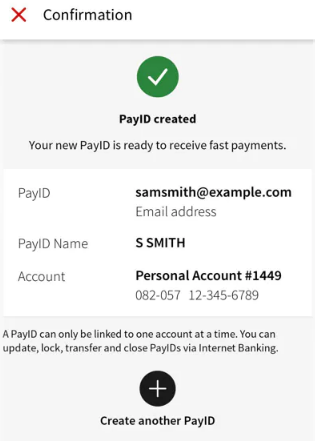

- You will receive an email, confirming that you successfully created your PayID

Regardless of whether you use a portable or desktop device, the process of linking your bank account to PayID is pretty much the same. The online banking platforms of the financial institutions might have some slight differences. But do not worry about that because banks provide their customers with cut-and-clear instructions to link a PayID to their accounts.

Note that you can link multiple PayIDs to your bank account, but the same PayID cannot be connected to more than one account.

| PayID Registration Requirements | |

|---|---|

| Copy of ID/DL | No |

| Utility Bill | No |

| Link bank account | Yes |

| Link bank card | No |

Depositing to Sportsbooks with PayID

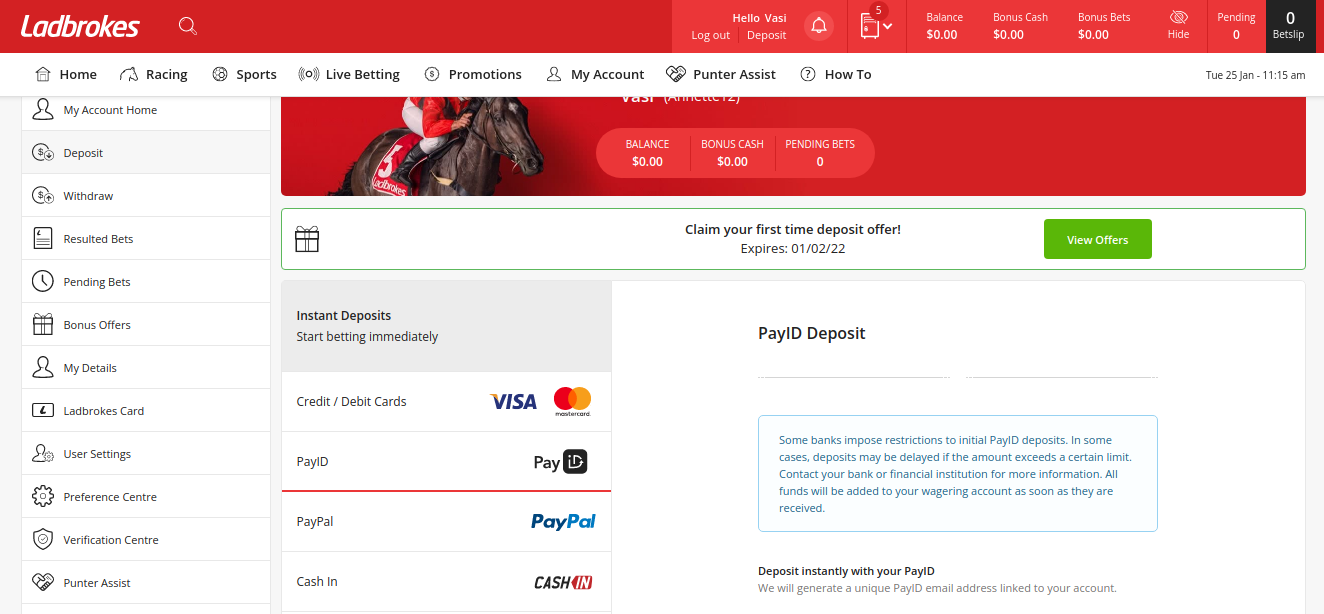

Some online sportsbooks looking to cement their presence on the Australian market accept deposits via PayID. The only currency the payment service supports is AUD. That comes as no surprise because PayID is focused on the Australian market. With PayID, punters can deposit funds to their sports betting accounts without the need to share their banking credentials.

Depositing funds to online sportsbooks via PayID is a hassle-free process. Furthermore, transactions carried out via PayID are processed almost instantly, meaning that the funds will appear in your betting account in a few seconds.

Some online sportsbooks do not allow deposits via digital wallets to make use of bonus offers. However, if you use PayID to top up your sports betting account, you can benefit from all promotions the web-based sportsbook offers.

Transaction limits vary between the different financial institutions, but some banks allow their customers to make payments via PayID of up to $10,000. As for the minimum limit on deposits, it starts from $10. In the lines below, we will walk you through the process of depositing funds via PayID to your sports betting account:

- Find an online sportsbook that accepts PayID deposits

- Set up an account and visit the virtual cashier

- Select the Deposit button and click on the PayID icon

- Click on the Generate PayID button

- You will see the PayID linked to the sportsbook’s account

- Copy it and log into your online bank account

- Select Funds Transfer, click on the Pay to PayID button, and enter the amount you want to deposit

- Paste the sportsbook’s PayID and verify the payment

- You will see the name of the account holder

- Click Next and select the bank account you wish to use for the transfer

- You can add a description in the 280 character field if you want and click Next

- You will receive a one-time security code that you have to enter to confirm the payment

Even if you do not use the payment service, you can deposit funds via PayID provided that the online sportsbook supports this payment solution. Keep in mind that first-time payments via PayID might be held for up to 24 hours for security reasons.

| Depositing with PayID Summary | |

|---|---|

| Timeframe | Instant |

| Minimum per transaction | 10 (varies between the different sportsbooks) |

| Maximum per transaction | 10,000 (varies between the different sportsbooks) |

| Fees | No |

| Available currencies | AUD |

Withdrawing from Sportsbooks with PayID

PayID supports payments in both directions. This means that you can deposit and withdraw funds via PayID. Punters will not experience any difficulties to cash out their winnings generated from sports betting because the process is painless. However, finding an online sportsbook that allows punters to withdraw their profits via PayID is not all plain sailing.

Online sportsbooks that do not allow punters to cash out via PayID offer alternative payment solutions such as Direct Bank Transfer. Punters from Australia can also use PayPal to withdraw their profits if PayID is not supported.

All online sportsbooks have a pending period to review withdrawal requests. This period varies, but most PayID betting sites take up to 3 days to process payment requests. Once the online sportsbook approves the request, your winnings should appear in your account on the spot.

- Log into your sports betting account

- Visit the virtual cashier of the sportsbook and click Withdraw

- Select PayID as a preferred withdrawal method

- Enter the amount you wish to cash out and provide your PayID

| Withdrawing with PayID Summary | |

|---|---|

| Timeframe | Instant upon approval |

| Minimum per transaction | 10 (varies between the different sportsbooks) |

| Maximum per transaction | 10,000 (varies between the different sportsbooks) |

| Fees | Most betting sites do not impose fees on withdrawals via PayID |

| Available currencies | AUD |

Fees Related to PayID Betting

PayID has gained unbeatable popularity because the payment service is suitable for sending and receiving money. Furthermore, financial transactions via PayID are fast and safe. But what makes PayID exceptional is that the payment service is free.

There are no fees for connecting a PayID to your bank account. PayID is directly linked to your bank account and does not store funds. Hence, you do not have to fund your PayID before using it. This is not only convenient but also budget-friendly.

Sports fans who decide to use PayID as a preferred payment method will be on cloud nine to learn that most online sportsbooks do not impose fees on deposits and withdrawals via PayID. However, punters should not forget to read the small print before joining a betting site.

Since the payment service is offered by different Australian banks and financial institutions, fees for holding an account with them might apply. But we cannot provide our readers with exact details on the matter as the fees vary between the different financial institutions.

| Fees Related to PayID Summary | |

|---|---|

| Initial setup | No |

| Account review | No |

| Maintenance fee | No |

| Inactivity fee | No |

Benefits of Betting with PayID

PayID offers plenty of advantages compared to other payment solutions. In this section of our review, we will take a closer look at the benefits of betting with PayID. We will leave the decision of whether PayID is suitable for your needs to you.

Easy-to-Use Payment Service

PayID is an identifier linked to your bank account. Hence, you do not need to provide a BSB code and other details to make online payments. If you want to send money to someone via PayID, you only need to know the person’s PayID. You can also receive money via PayID by providing the sender of the money with your PayID. The payment option circumvents the need to remember banking credentials.

Transactions are Processed Instantly

One of the main advantages of PayID is that financial transactions are carried out on the spot. With PayID, punters can forget about annoying delays. Deposits via PayID are processed instantly, providing sports fans with the opportunity to place a last-minute bet. We have to admit that most payment solutions process gambling-related payments instantly. But not all of them allow punters to cash out their winnings within a couple of minutes upon approval.

PayID is a Fee-Free Payment Solution

PayID is not an independent payment solution. It is a service that many financial institutions and banks support. At the moment of writing this review, PayID is a free-of-charge service. Therefore, you will not incur fees when depositing funds to your sports betting account via PayID. No fees apply to withdrawals via PayID, either. So, instead of paying some burdensome fees, you can use PayID and invest more money in your sports betting hobby.

A Secure Payment Option with a Good Reputation

PayID is recognized for its high security. The payment service employs the safety measures of your bank. Banks and financial institutions are known for implementing only high-end security measures. PayID is supported by the most trusted banks and financial institutions, meaning that there is no doubt that it is safe and reliable.

With PayID the risk of sending money to the wrong recipient is minimal. Every time you want to transfer funds to someone, the system will detect the owner of the bank account and show you the name of the recipient. Hence, you can double-check whether you are sending money to the right person or business.

No Registration Required

We all know how tedious and time-consuming a registration process can be. But if you want to use PayID’s services, you do not have to set up an additional account and remember login credentials. The only requirement is to have a bank account with a participating bank or financial institution. Finding a bank that offers PayID is not a hassle because you can choose from over 100 financial institutions.

Hight Transaction Limits

Some payment solutions have very tight transaction limits, making them unsuitable for sports fans who want to deposit large amounts of money. Fortunately, that is not the case with PayID. The limits on transactions via PayID are determined by the different participating financial institutions. Some banks allow transactions of up to $10,000 via PayID.

Drawbacks of Betting with PayID

PayID offers plenty of advantages, but it’s not all roses. Sports fans who intend to use PayID will have to put up with several disadvantages of the payment method. Keep on reading to find out more about the downsides of the payment solution.

Available in Australia Only

The most notable disadvantage of PayID is that it is geared toward the Australian market only. Therefore, the only currency it supports is AUD. Sports enthusiasts who reside outside Australia will not be able to use the payment method.

PayID is Not Widely Accepted

Although PayID is a popular payment option in Australia, not many web-based sportsbooks accept the payment solution. It is even harder to find a betting site that allows punters to cash out their profits via PayID. Most betting sites that take PayID payments will urge you to select an alternative payment method to withdraw your winnings.

No Live Chat Customer Support

PayID has an official website where you can find an informative FAQ page. Unfortunately, if you do not find the answer to your question, the only communication channel through which you can contact the company’s customer support department is email. It is certainly disappointing that the payment solution does not offer phone or live chat support.

PayID Cannot Be Used for Withdrawals From Your Account

Another disadvantage of PayID is that it cannot be used to withdraw funds from your account. If you want to cash out your winnings from an ATM, you have to transfer the money to your bank account.

Regulation and Availability of PayID

PayID was established by 14 of the most reputable Australian banks, including the Reserve Bank of Australia. The payment service was introduced as part of the New Payments Platform. In September 2021, Wise Australia joined the national payment infrastructure. As a service that functions within the NPP platform, PayID is supervised by Australia’s most trusted banks and financial institutions.

PayID is a payment service designed to cater to the needs of Aussies. Hence, if you reside outside Australia, you cannot use PayID’s services. The payment option is supported by over 100 Australian banks and financial institutions. If you want to use PayID, you should have an online bank account at a participating bank.

In 2012, the Reserve Bank of Australia’s Payment System Board concluded that the Australian payment system needs improvement. As a result, industry experts joined forces to create the Real-Time Committee. The Committee had to observe international payment systems and come up with a plan to improve the payment system in Australia.

In 2014, the NPP Australian Limited was established to oversee the NPP platform. In 2017, the NPP was introduced, and only a few institutions enabled the platform to test it. A year later, the NPP and PayID were officially launched. The idea behind PayID is not to replace the BSB or account number, but to facilitate real-time transactions.

Some online sportsbooks geared toward the Australian market have already implemented PayID. However, the number of betting sites that accept PayID payments remains modest because the payment service is focused on the Australian market only.

PayID Security

When selecting a payment solution, it is crucial to make sure that it is safe and reputable. Aussies can have the peace of mind that their hard-earned funds are in safe hands with PayID. The payment service is supported by the most respected banks and financial institutions in Australia. With PayID, it is almost impossible to make a mistake and send money to the wrong person or business.

PayID is a payment service offered by different financial institutions. Therefore, it uses the safety measures employed by the banks that support it. As you know, banks use cutting-edge safety technologies to protect their users’ sensitive information and transactions. Moreover, if you want to send money to someone via PayID, you have to authorize the payment before being processed. You will receive an SMS with a security code that you have to enter to confirm the payment.

NPP payments are subject to fraud checks. Besides, when creating a PayID, you will be required to verify your identity and prove that you are the rightful owner of the information. Financial institutions and banks that support the payment service provide their customers with tips on how to protect themselves from scams.

| PayID Security Summary | |

|---|---|

| SSL | Yes |

| Two-factor authentication | Yes |

| Face ID | Varies |

| Touch ID | Varies |

| App/SMS notifications | Yes |

PayID Reviews From Around the Web

PayID is a popular payment solution on the Australian market. It was rolled out in 2018, but for the short time of its existence, it has attracted a great deal of attention. In July 2020, the NPPA reported that over 5 million customers use PayID.

The payment service is suitable for online purchases and gambling-related transactions. Unfortunately, the number of online sportsbooks that support the payment solution is modest. That can be attributed to its newness. But in our opinion, it is a matter of time for more operators to realize the advantages of PayID and add the payment service to their lists of supported banking solutions.

We always keep our ears to the ground when reviewing payment methods, but we could not find any reviews about PayID. On the official site of the payment service, we came across a section called PayID in Action where PayID users shared their experience with the payment method. However, we prefer to rely on the customers’ reviews published on independent websites.

Conclusion

PayID is an excellent payment solution that is available to Aussies only. The payment service is a real breakthrough in the sphere of online payments. Transactions are processed instantly and at no cost. Furthermore, the payment option is supported by banks and financial institutions that adhere to the highest safety standards.

PayID is also suitable for gambling-related payments. A bit of a letdown is that not many online sportsbooks support this payment solution. However, if you find a betting site that accepts PayID payments, do not hesitate to join it and enjoy the multiple advantages that PayID offers.

Registering an Account

Registering an Account